Regarding and come up with a must-keeps house provides list to provided some other loan brands, listed below are some these tips in order to economically get ready for domestic to shop for.

Gonna buy a produced otherwise standard household however completely yes how to ready yourself? Regardless if you are an initial-date family visitors or it’s just become a bit because you ordered a property, we are able to help you to get in a position. Go after such pre-get info in the Clayton people to be certain your house to find process goes smoothly.

Before you jump for the home google search, consider what your brand-new household requires. Wonder questions regarding what type of family you’re looking for, anywhere between what floor agreements you’d rather if you like places for example a washing space or office at home. Anyway, we should become pleased and you may comfortable in your geographical area, therefore positively offered your needs are going to be an initial step.

- Would you like more room? Mention the minimum number of rooms and you may restrooms you would like and add any shop have on the have to-features number.

- Really does anyone regarding the domestic performs remotely or take online classes? A bend room otherwise private office are high priority when you will be searching for an alternative household.

- Make sure you remember about your welfare. Choose to bake otherwise repurpose chairs? Come across land with a lot of counterspace and you can a home island, or opt for a garage as your workshop.

Prioritizing has such as these allows you to restrict your pursuit and keep maintaining you centered because you transfer to figuring out your own funds.

Check your month-to-month income and estimate exactly how much you might place towards the a monthly mortgage payment and you can home insurance. It is also a good idea to reason behind another costs you to are not are present after you individual a home. Such, for individuals who currently live-in an apartment as opposed to a yard, consider there may be a lot more lawn care will cost you so you can basis toward your financial budget.

Locating and you may throwing these data files as soon as possible might help the borrowed funds acceptance process run better since your guidance is also feel confirmed more quickly

Getting sensible regarding your cash allows you to determine what price range you should be lookin in. I highly recommend making use of your the newest cover several months to get always one change and observe safe youre economically. If you feel particularly cash is a tiny strict, you could reassess your budget.

I plus strongly recommend avoiding incorporating people the fresh new expense otherwise borrowing from the bank questions which come out of and come up with huge sales particularly a different auto otherwise making an application for another type of credit card while you are positively seeking to get a home.

Your credit rating is a vital grounds lenders thought when evaluating the financial application. It does change the mortgage quantity and rates your be considered to own. Avoid people shocks by checking your credit rating free of charge before obtaining financing. By doing this, if you see any wrong suggestions placed in their history, you might argument one mistakes which are often harming their get. When your score isnt the place you want it to be, it is possible to make a plan to evolve their borrowing as you save for a house.

When you find yourself purchasing a property, you will need to contemplate there is extra will set you back in it beyond precisely the downpayment. Ready yourself by the protecting up getting things such as settlement costs, that will are very different according to the price of the house you might be to get together with financing you choose.

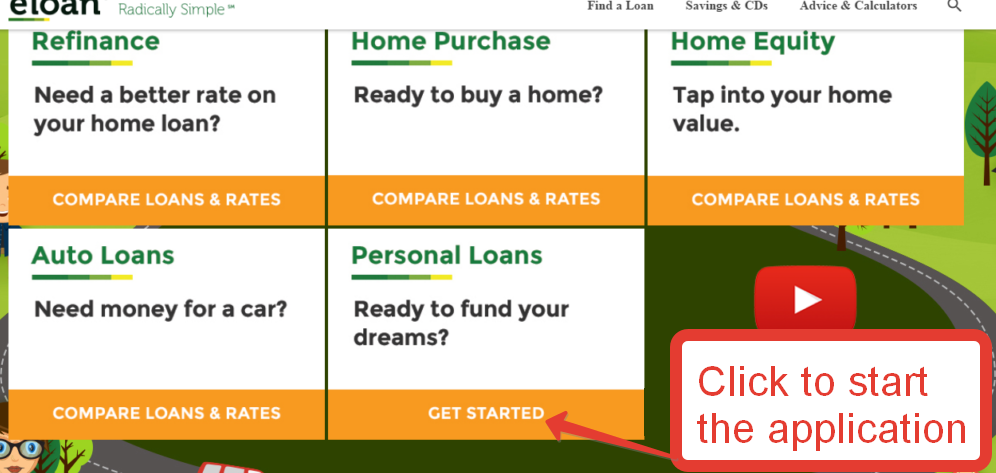

Particular mortgage items are a far greater fit for your position as opposed cash advance to others, thus you should realize about the requirements for several finance to ask their lender regarding the. Alternatives tend to be, however they are not limited so you can, antique, FHA, USDA otherwise Va money. At the , you can find out about earliest-date property applications that can easily be found in a state.

Without a doubt, you can not forget the fun part of household google search. Within Clayton, we should build wanting a property simpler, that is why you can search on the web to own are produced and you can modular house available towards you and you will filter out them by the quantity of rooms, budget and features you would like. It is possible to visit your regional domestic center so you’re able to trip their favourite house and you may keep in touch with the house experts regarding the questions you could have regarding home buying processes.

USDA money are typically intended for homebuyers from inside the outlying section, and you can Virtual assistant finance is to have solution participants and you will experts otherwise its partners

According to the bank you select, loan terms and you will charge may differ, while the version of fund the lender could possibly offer. Some specialize in mortgage loans to have are built and you may modular land particularly.

When choosing their lending company, evaluate rates of interest, the particular loan fees and the needed advance payment. And additionally query for every single bank if they have applications readily available for down commission recommendations. For those who have any extra inquiries, be sure to ask your lender in order to better know the process.

You could ask lenders having a list of information you can have to promote while you are trying to get that loan, but most loan providers tend to request well-known files relating to a job history and you can evidence of money. Check out examples of what you could be required to provide:

- Taxation statements and you will W-2s or 1099s for the last two years

- Latest spend stubs

- The Public Cover credit and you will license or ID

- Bank comments regarding the last step three-six months

- If the appropriate, documents for income out-of old-age, Personal Safety, alimony, youngster service, etcetera.

Now that we’ve got been through these of good use procedures, do you wish to check out particular a lot more real estate information? You can discover on the home To invest in section toward the Business site. Incase you’re in a position for another actions, you can create a good Clayton MyHome membership to keep your favorite flooring arrangements and features, here are a few much more about new to acquire processes and you can apply at good house expert all in one place.

English

English

Bài viết liên quan