from the Neal Frankle, CFP , The content signifies new author’s thoughts. This particular article may have associate hyperlinks. Please read all of our revelation for more information.

You can file for bankruptcy and never eradicate your property security. I’d like to illustrate exactly how by responding an e-send I gotten out-of B.

My husband and i work at a tiny realtor industry. We imagine it was among the best providers suggestions we you may developed. But once the construction bubble started initially to burst we had three spec residential property in the market offered. We’d so you can borrow secured on the house to keep our house and make use of handmade cards to assist pay our personal expenses.

Even as we sold the spec homes, we wound up with a financial obligation out of $30,000 on handmade cards and you can a massive $forty-five,000 from inside the collateral finance facing our home.

I have about three small kids. Whenever we offer our house we could possibly create sufficient to pay right back everything you, however, do not know where to go following that. Nobody is planning to lend all of us currency to possess a different mortgage and you will all of our latest homeloan payment isnt sensible.

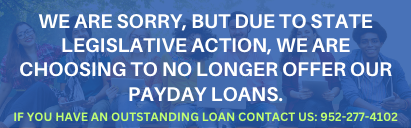

I’m scared of shedding our house whenever we apply for personal bankruptcy and never having the ability to get home payday loans Staples financing that have bad borrowing from the bank ever again. Help!

Simple tips to Declare themselves bankrupt and not Eliminate Your home Guarantee

There is a lot going on there having a busy absolutely nothing Pilgrim at all like me. To own today, let’s focus on the a residential property question:

I’ll think that you currently attempted to personalize your own finance and creditors commonly working with you. I am along with attending think that your current financial will be affordable in the event your almost every other expense was in fact released.

Should you want to hold on to your property and not seek bankruptcy relief, visit your creditors and you may discuss difficult. Strive for them to reduce your costs and rates of interest. Buy them the to modify the brand new loans. It is outside of the scope for the article to go over this step. I will guess you currently over one. I will perform another type of review of loan modification when you look at the the long term assuming…stay tuned.

Just remember that , even although you do that, their borrowing from the bank is probably attending require some attacks and this will hurt your credit score assortment and you will upcoming funding feature. However, right now, We would not worry about upcoming financial support options. I might manage leaving the issue you are in today.

Let’s examine filing for personal bankruptcy and waiting on hold on family collateral.

The initial option is to file chapter 7. This should enable you to get out of beneath your expense, you must be careful.

a good. There is no security together with bankruptcy proceeding trustee abandons the home. This means that the fresh trustee realizes the new collateral is so lowest it’s not worth every penny, so she doesn’t go after the home. In this case, you have still got making mortgage payments however you might get rest from your most other expense.

b. You have got security, but it’s below the exemption matter. All state has actually a bankruptcy proceeding exemption matter that you’ll make use of. Thus, should your condition has a keen exemption level of $75,000 additionally the guarantee in your home try $75,000, you can keep your house while it enjoys equity and you can still state a bankruptcy proceeding personal bankruptcy to locate respite from one other loans.

An alternative choice will be to state part thirteen bankruptcy. This can be a good work out plan instead of a means for your requirements to acquire a flush record. You’ll wade which channel should you cannot qualify for option a or b above.

English

English

Bài viết liên quan