Editorial Assistance

If you have a huge amount of cash consuming a hole on your own pocket and so are shopping for lower mortgage repayments, envision inquiring the bank to own a home title loan Alabama loan recast. A home loan recast are an easy way to changes how much cash your spend monthly as opposed to refinancing your own home loan. The lending company often apply the extra funds towards the loan harmony, then recalculate how much cash you have to pay every month. You will observe straight down monthly obligations and you will save plenty inside desire more than living of your own loan.

We are going to take you step-by-step through the brand new finer details of a home loan recast, go over how it differs from an effective re-finance that assist your choose whether it’s right for you.

Why does a mortgage recast works?

You are able to a mortgage recast to lessen your mortgage payment instead of refinancing. However,, in the place of a refinance, the brand new regards to your own home loan – such as your rate of interest – wouldn’t changes. Here’s how it works:

- You will be making a large, lump-contribution fee. Some lenders lay the absolute minimum because of it large percentage, however, your will most likely not. Just remember that small your own swelling-contribution commission, this new smaller your monthly obligations varies after the recast.

- Your lender recalculates the loan count. Loan providers have fun with a system called amortization to consider exactly how your loan count and you can rate of interest impact your lowest payment. The loan identity will stay an identical, but with an inferior equilibrium to settle, you have all the way down payments every month.

- You pay a beneficial recast commission. The price tag amount is perfectly up to their lender but would-be short compared to the exactly what you’d pay inside the re-finance closing costs. Those individuals can be set you back any where from 2% so you can six% of loan amount.

- You are free to take pleasure in down monthly installments. Your bank will begin battery charging your for the the newest, down amount per month, and you’ll continue steadily to build these payments till the financing is paid back. Your smaller mortgage equilibrium does mean you’ll be able to spend less within the interest full since the you will be settling the loan shorter.

Mortgage recast example

Let’s say the loan is a 30-seasons fixed-price mortgage with good six.94% interest and you can a left equilibrium out of $98,900. You have decided to place $sixty,000 on the newest recast, as well as your bank is charging a good $five hundred recast payment. Here is how a recast varies your own financial:

Do i need to recast my personal home loan?

You should know recasting the mortgage when you yourself have a giant sum of money easily accessible and want a lesser mortgage repayment without having any problems (otherwise bills) away from refinancing. Before you make any motions, however, be sure to be sure your loan qualifies – mortgages supported by the fresh Government Housing Administration (FHA loans) or You.S. Service regarding Veterans Activities (Virtual assistant financing) can not be recast.

Before you could dive on good recast, weighing new monthly coupons it might give up against additional selection. Do you really be better off using your more money to experience high-desire loans or strengthen the disaster finance?

> You bought a special home ahead of selling their earlier that. If you had to obtain a loan order your latest home and you may were not capable sell an earlier house ahead, you could recast your own mortgage to the purchases proceeds as soon as your old domestic sells.

> You want to beat financial insurance. You might be always necessary to pay money for individual mortgage insurance rates (PMI) or even put no less than 20% off once you get a property. After you arrived at 20% home based guarantee, but not, you might terminate your own PMI. Using extra fund while in the a great recast helps you arrived at one to threshold.

> You’re getting prepared to retire and want a minimal you are able to fee. A great recast home loan may help perform space on the budget, particularly when you may be working with smaller advancing years earnings.

Same interest. Your current interest stays a similar thus, oftentimes once you are unable to re-finance towards the a loan having good lower rate of interest, a good recast can invariably make sense.

Down charges. Most lenders charges a good $150 to help you $five-hundred payment for home financing recast, which is much cheaper than just investing refinance closing costs.

Faster documents. It’s not necessary to render earnings documents and other being qualified economic files as you do whenever refinancing.

Prepared symptoms. Most loan providers want evidence of at the very least six months’ value of money one which just recast your financial.

Home loan recasting against. refinancing: That’s ideal?

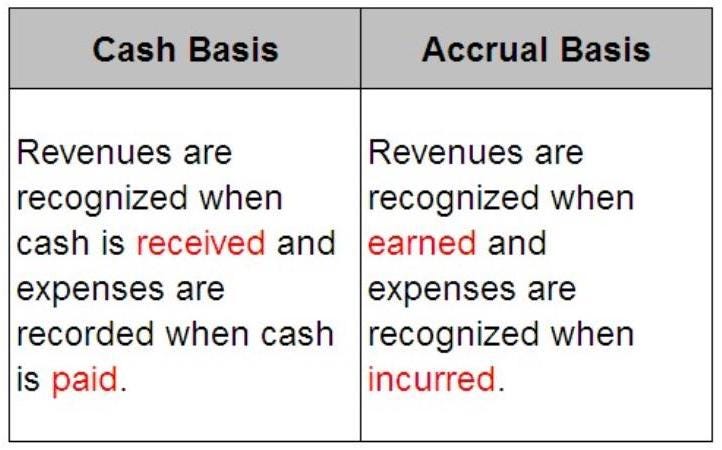

A home mortgage refinance loan occurs when your change your newest mortgage which have a completely brand new one, always at the a lowered rate. This new desk below suggests if this was best to choose home financing recast otherwise refinance.

A home loan recast is sensible if:

- You may have a lump sum you are able to to spend off the prominent equilibrium

- You are happy with your rate of interest

- You won’t want to otherwise can not be eligible for an excellent re-finance

Home financing refinance is practical if the:

- You can purchase a lowered financial rates

- You should change to a new loan system otherwise tap your house guarantee

- There is no need the bucks to spend off your dominating harmony

Alternatives to an effective recast home loan

Without having a big hide of money available for good recast, you might however pay-off the loan less and reduce attention charges with the choice:

Biweekly money

You might establish biweekly costs, meaning that you can shell out half your monthly mortgage repayment the 14 days, in place of make payment on complete amount monthly. Because specific weeks is actually longer than anybody else, you will end up putting some same in principle as you to definitely extra payment per month throughout annually. Simply create your objectives recognized to your own bank – or even, you could end up with late charges for folks who just start expenses half their homeloan payment every two weeks.

Additional costs

There are many methods lower your own mortgage to come of schedule. Incorporating merely an additional $fifty otherwise $100 towards the lowest mortgage payments is a straightforward answer to chip out at your financial equilibrium. You may also generate unscheduled payments anytime if you features extra money available to you. Be sure to allow your financial know you prefer the excess money used on your dominating harmony, perhaps not your own a fantastic attract matter.

Beat PMI

One means that may get your domestic equity doing 20% can help you lose high priced PMI costs. Check out approaches to imagine:

> The newest appraisal. Should your house’s worth has increased significantly, just delivering an alternate domestic assessment helps you get rid of PMI. When your home’s appraised worthy of return sufficient, you can pass the fresh new 20% collateral pub instead of making any extra money.

> Piggyback refinance. And here you are taking away a refinance mortgage and you can an effective smaller second financial at the same time. The refinance loan will cover as much as 80% of the home’s worthy of. The second financing – always a home equity financing or family security personal line of credit (HELOC) – will cover the essential difference between your existing equity and also the 20% you need to avoid PMI.

English

English

Bài viết liên quan