Recognized

Finance on the Mobile property are becoming ever more popular because lets you to do the mortgage need irrespective of your credit position.

These loan can be obtained now during the Canada and its in your cellular home that is certainly gone out of one location to a special and can end up being while the a guarantee to have the loan.

Getting a loan on your mobile residence is one of many an excellent behavior you could actually build if you need to feel funded, and you can have a handful of important reasons and you may a few to take this type of loan. It could be for remodeling your current cellular family, it can be a down-payment for choosing another cellular house, and it can getting to have whatever in need of assistance to-be funded from the front.

It hardly things how much the amount of financing is on your cellular home in this a limit out of $fifty,000. The first is that it could be funded for the an actually quite easy processes no matter if you’ve got a bad credit get or no borrowing from the bank at all.

Constructed land get expensive, without matter how quick property was, it will cost your a significant. Hence, numerous individuals have moved on so you can mobile property. These residential property are easier to and get than other solutions. The best part, if you don’t have adequate cash to acquire a mobile home, you could use cellular lenders.

These finance would be having yet another otherwise second-hand home or renovating the latest modular domestic room. Having cellular home mortgage funds, individuals score aggressive pricing and flexible plans based on its monetary standing.

Surely, the procedure getting mobile a mortgage will be confusing, especially if this is your first time. You could potentially ponder in the event the loan providers will provide you with a loan having cellular a home loan, just how to qualify, and exactly how are these loans not the same as signature loans. If you think perplexed, a brief guide keeps you on the right track.

Just what are Cellular Home loans?

These properties are more popular amongst the masses which can’t manage high priced features. During the simpler terminology, mobile homes is actually a viable solution, along with cellular mortgage brokers in Canada, you’ll not need program a single penny.

Everything you need to select was a loan provider who can render you money for those homes. Might require requisite paperwork, like:

- A description of one’s movable possessions : Provide factual statements about the cellular residence’s rates and you may proportions on the financial.

- Borrower’s income source : Lenders will need to see your source of income. With a steady employment or source of income advances the possibility of going that loan.

- Factual statements about advance payment : But if, you plan to expend a deposit, tell your bank ahead of time.

Such affairs dictate your odds of bringing a loan. Loan providers often feedback that it number to ensure your own demand is secure to help you agree. At all, they are paying a tremendous amount and can’t getting uncertain.

Will a bad credit Score Apply to My Loan https://availableloan.net/loans/short-term-loans/ application?

/images/2019/07/15/discover-it-cash-back-300x189.jpg)

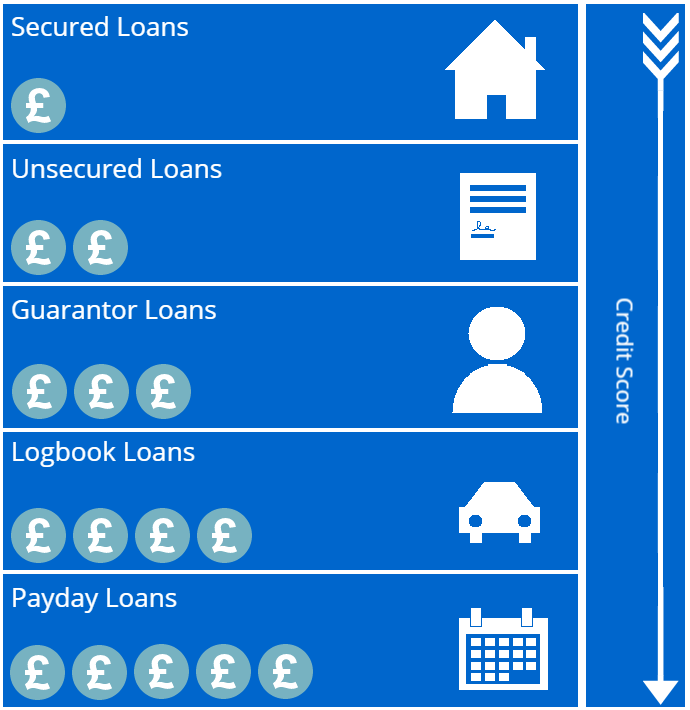

A good borrower’s credit score issues for some lenders however so you’re able to men. Your credit score reveals whether you came back earlier in the day funds of course just be leading with such as for example a large amount. A high credit rating ways youre a secure financing. Additionally, average otherwise reasonable credit rating throws your in the a deep failing situation.

Loan providers can enjoy an effective borrower’s poor credit rating because of the battery charging them highest attention. However, FEL Canada cannot believe in judging some one based on credit records. You can expect reasonable-attention mobile a home loan for poor credit. You could buy your dream mobile house or pay so you’re able to renovate your existing modular domestic.

Where to find a lender?

It’s needed seriously to see a loan provider whom offers the finest pricing to you personally for your financing. Discover additional conditions revolving around a loan. Including, every loan arrives in the a particular interest, and you’ll choose a low-interest. In the event that a loan provider estimates a high interest, there is certainly challenging to invest back the borrowed funds count while the total attention.

Also, monthly premiums are very important on the price. Make sure to get a hold of a lender who also offers comfort. Ask your financial on penalties having destroyed a number of monthly premiums. Just after you are obvious throughout the these issues, move to the program processes.

Many financial institutions may not feel comfortable delivering fund for cellular homes, you could faith FEL Canada so you’re able to facilitate you which have cellular a mortgage getting poor credit. Regardless of the kind of domestic you choose, we shall financing they to you personally. Our recognition speed try large, and consumers obtain the matter within their account inside twenty four hours otherwise several.

You don’t need to visit one part or satisfy contractors. Our very own website allows everyone to help you submit an on-line application thereby applying for as much as $50,000, no borrowing checks. However, if, you require additional info, feel free to contact us as a result of all of our helpline or email address united states your matter.

English

English

Bài viết liên quan