Unlocking an informed re-finance terms

Refinancing their mortgage feels as though matchmaking-inquiring the proper issues upfront can save you a whole lot of trouble in the future. Just as you wouldn’t invest in a relationship without knowing new maxims, diving towards the an effective re-finance without proper requests will cost you big style.

Negative and positive times so you’re able to refinance

There are occasions – when home loan costs was shedding quick – whenever refinancing is a zero-brainer. Providing your brand new speed is at least 0.5% below your you to, refinancing is normally of use.

And you may, away from , mortgage prices had been for the an obvious down pattern, even though there was a great amount of highs and you can troughs in the process. Thus, really property owners refinanced periodically.

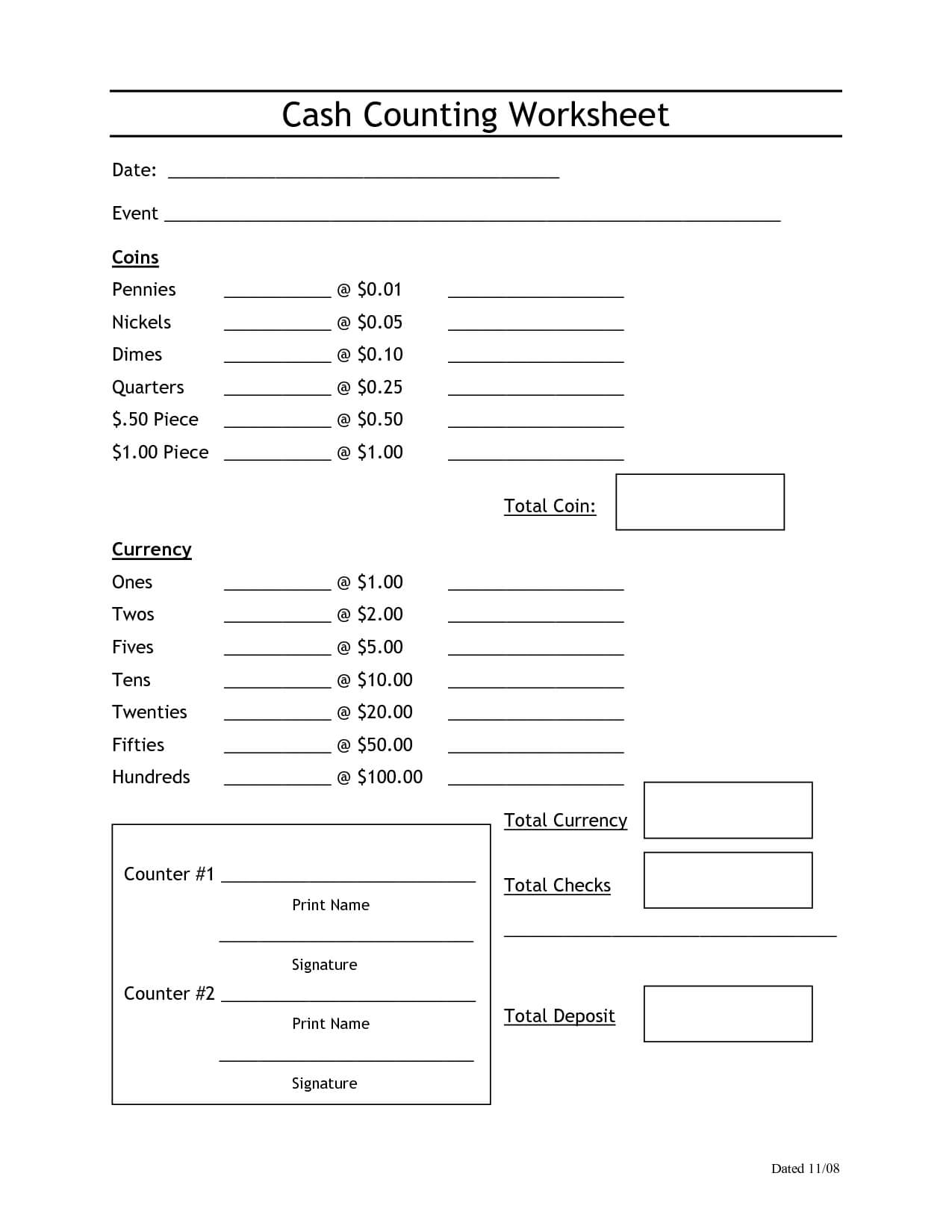

Source: Freddie Mac computer, 30-Seasons Repaired Speed Financial Mediocre in the us, recovered from FRED, Federal Set aside Bank out of St. Louis

However,, while the start of 2021, up until this particular article try created, home loan costs was in fact for the an upward pattern. And you can a lot fewer owners have been refinancing.

Fannie mae reckons one to, into the few days ending , new money level of refinance apps is off 88.6% compared to re-finance boom one to happened into the third quarter from 2020.

- And come up with increased payment

- Stretching out committed they are paying for their house, usually incorporating somewhat on the full amount their attention will definitely cost all of them

However, most of us hope to see the get back of a falling pattern in the financial rates; residents helps you to save thousands. But it hadn’t yet turned up when this post is actually authored.

Whenever refinancing is useful even after rising prices

Refinancings can be rarer than they used to be but they’ve far out of disappeared. Some people nonetheless get valuable advantages of all of them. Very, what would those become?

Well, periodically, somebody who closely inspections home loan prices you’ll location your current financial rate is 0.5% less than its present rates. After that, they might manage good rate-and-term refinance, that submit a diminished home loan rate in the place of extending the entire mortgage name.

Cash-aside refinances can be an excellent

However,, commonly, it’s because anybody demands a money-away refinance. You improve your current financial having a larger you to definitely and you can walking away having a lump sum payment of the difference, without settlement costs.

If you find yourself refinancing so you’re able to a bigger financing at a higher rate, you’ll find noticeable disadvantages. You are highly planning to score a much higher payment per month and you will the complete price of credit to purchase your household rockets.

https://paydayloanalabama.com/malcolm/

That is not specific. Instance, should your credit history is much high plus debt obligations below once you applied for your financial, you happen to be given a low rates. However your monetary things might have required turned in order to get next to compensating for home loan rates’ rising pattern.

You happen to be in a position to reasonable the outcome on your own monthly percentage (perhaps even score a reduced one) from the stretching the time you’re taking to blow off your home loan.

Instance, assume your 31-year home loan could have been opting for two decades. If you get another 31-year loan, you are dispersed your instalments more half a century. That can assist together with your monthly premiums but will be sending the fresh overall amount you have to pay in the interest sky high.

Very, as to why refinance? While the either you want a finances treatment so terribly the (mainly deferred) aches may be worth it. Envision you have got crippling bills one threaten every facet of your own existence, together with your household. Otherwise that you’ve become a separate dollars-eager organization. Otherwise you are quickly up against an inescapable and you can unplanned connection.

Perhaps a money-out refinance can be your best way forward. But, prior to deciding thereon, listed below are some home security finance and you can household guarantee credit lines (HELOCs). With our 2nd mortgages, your existing financial stays set up and you also pay increased price only on your own the brand new borrowing from the bank.

English

English

Bài viết liên quan