Household guarantee funds enables you to borrow cash with the collateral of your home while the equity, possibly within a lower life expectancy rate of interest than simply a consumer loan. You will get a lump sum payment mortgage that you can use to own house home improvements, repaying loans, or perhaps to fund your child’s degree.

However, just remember that , domestic collateral money incorporate the individual positives and negatives – so that they are not right for folks.

What is a property security mortgage?

Property security loan are a second home loan. You may be borrowing up against the security of your property, the difference between how much cash your property is currently really worth and you can what you owe in your financial (and every other personal debt shielded by the house). It means the lender normally foreclose on your property for individuals who are unable to pay your loan back.

Although this is a risk, experiencing your home’s equity would be a simple way to help you gain access to alot more credit when it’s needed as long as you’re able pay-off the loan.

This is how it truly does work: With a house equity mortgage, your home serves as guarantee. Because it’s a secured loan, you might qualify for a diminished interest rate than the almost every other different credit (eg an unsecured loan).

How come a property guarantee financing work?

Property collateral mortgage works like a consumer loan inside the which you can discover the financing in one single lump sum a few days shortly after closure. Domestic guarantee money is fully amortizing, meaning for each and every commission minimises your dominating and you will attract. And in case you make every commission, you’ll be able to fully pay the loan towards the end of your own title.

Financing terms will vary by mortgage kind of and you will lender. The minimum name you likely will look for was five years, although not, some can be much time just like the 3 decades. Household equity fund has fixed installment terms and conditions and you can fixed rates of interest.

Tip: For people who promote your home ahead of your residence collateral financing try totally repaid, you will have to spend the money for balance at closing (or pay off their credit line), before possession was relocated to the buyer.

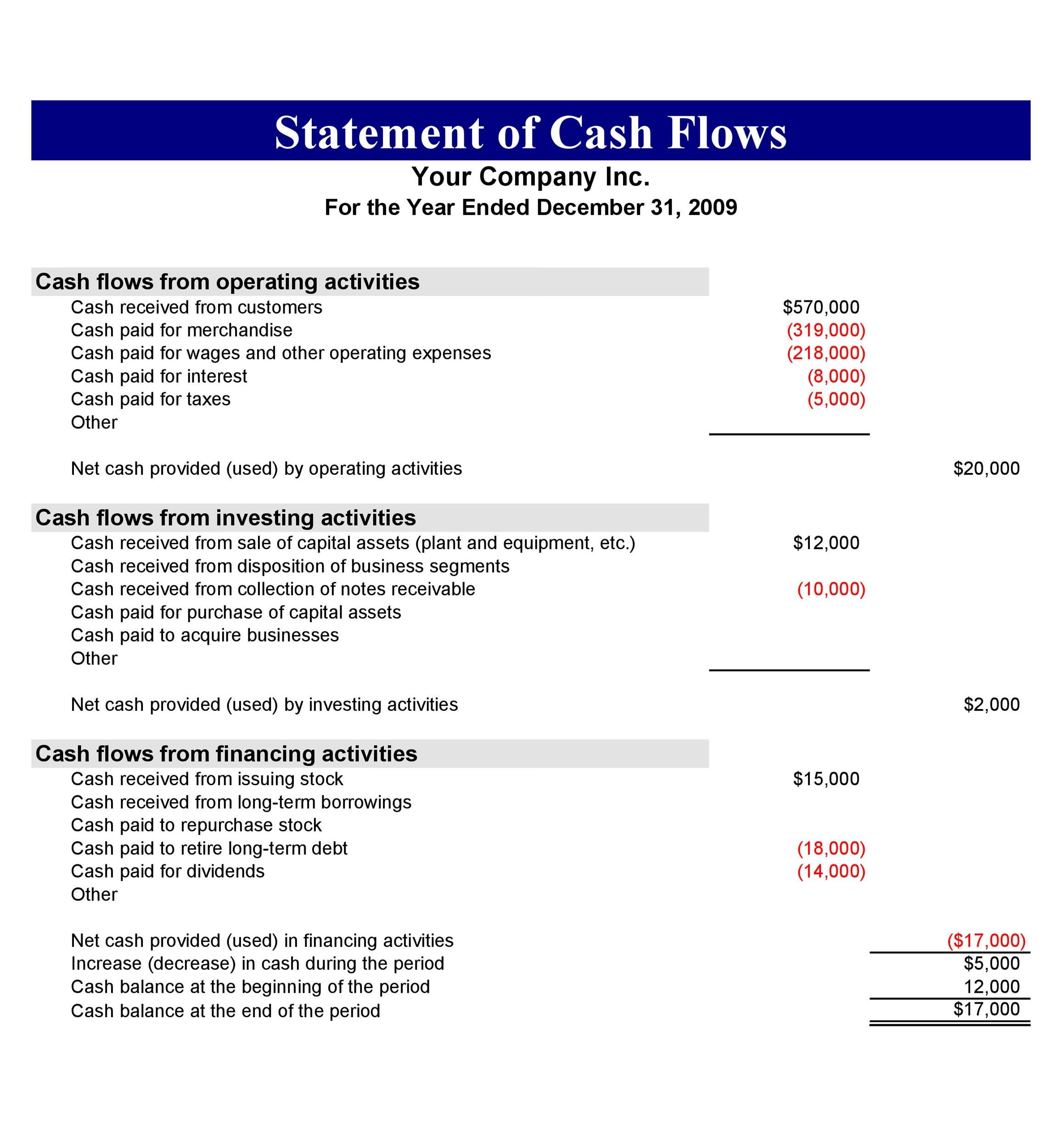

Domestic equity financing prices

Household collateral fund provides fixed rates. These pricing become greater than costs to other things that permit you availableness the security, eg home security lines of https://www.paydayloancolorado.net/mancos credit (HELOCs) and money-aside refinances. Things one to dictate this price you pay include:

The next table shows the typical lowest speed getting property collateral mortgage and HELOC of a sample of loan providers, as well as the low and you may high prices tested. Their rate .

HELOC against. domestic guarantee loan

Technically, family guarantee financing and you can HELOCs are two corners of the same money. The real difference is actually the way the funds are arranged and exactly how the cash try paid.

A house security loan try a payment loan in which you’re going to get a lump sum and you will pay it off in equivalent monthly payments more a number of years.

With an excellent HELOC, you get a line of credit that you can obtain from as required to own a predetermined period of time (known as the mark months). Once the mark several months ends, you are able to go into the payment period and you may pay off everything you borrowed and additionally notice. HELOCs will often have adjustable rates of interest.

Just how much ought i borrow with a house collateral financing?

The total amount you could potentially borrow relies on the degree of collateral you really have of your home, your credit score, and how much of your monthly income can be acquired to settle that loan.

How to assess my personal residence’s collateral? So you’re able to assess just how much security you really have, research your house’s current market otherwise appraised really worth, after that deduct your home loan balance about amount.

English

English

Bài viết liên quan